WE ARE CREDIT EXPERTS

Your credit score is the most important three-digit number in your life. Raising your credit score Improving your credit can lead to savings of hundreds of thousands of dollars over the life of a mortgage. In addition, a higher credit score better credit profile can help you with credit card rates, auto loans, and help you get that job you wanted.

Sometimes, though, life can get a little out of hand and you may fall behind in bills, run up a lot of debt or make other mistakes that can ruin your credit score. A bad credit report will raise your interest rates and make it even more difficult to catch up. That is where we come in.

We offer credit and financial consulting and work to raise your credit score improve your overall credit profile, so you can recover and save thousands to hundreds of thousands on your mortgage, credit cards and more.

SNEAK PEEK AT OUR SYSTEM

Check out the state of the art and secure technology we use to raise credit scores.

HOW WE RAISE CREDIT SCORES HELP TO IMPROVE YOUR CREDIT PROFILE

We attack your credit from multiple angles.

First, we work with you on devising an action plan for things you can do to maximize your improve your credit score credit profile, simple adjustments to the way accounts are being reported can have a massive impact on your overall credit grade, and profile. We educate you every step of the way so you know how you can continue to manage your credit long after your time with us.

Next, we raise your credit score work together to review your credit line by line to identify and items that are potentially reporting incorrectly, items that are outdated, unverifiable, misleading, or questionable. We assist in the correspondence needed to interact with the major credit bureaus and your creditors to remove or correct these questionable negative items from your credit report.

During this entire process, you are able to login to your file 24/7 to view recent activity, messages from our staff, and to see what negative items have been removed from your report. The most important part is that everything we do to raise your score is 100% legal and governed under the Credit Repair Organizations Act.

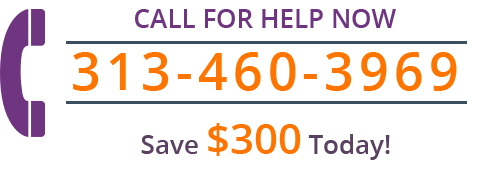

Our clients have the opportunity to save hundreds of thousands on their mortgage, credit card bills or even their car insurance. Call us at (313) 460-3969 for a free consultation...you have nothing to lose!

Request A Free Consultation Business

Credit Resources

Federal Law mandates that your credit report be made available to you freely on an annual basis. The three credit bureaus, Experian, Equifax and TransUnion all make your annual reports available at

View All Resources »

Credit Articles

Top Ways to Manage Your Debt Ratio

Debt ratio is the difference between the amount of debt you have charged versus the amount of money... Read More

How a Bad Credit Score Can Hurt You

While a credit score may seem like an arbitrary number, calculated by an invisible credit agency with... Read More

View All Articles »

313-460-3969

313-460-3969